The Definitive Guide for San Diego Home Insurance

The Definitive Guide for San Diego Home Insurance

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Program

Relevance of Affordable Home Insurance Policy

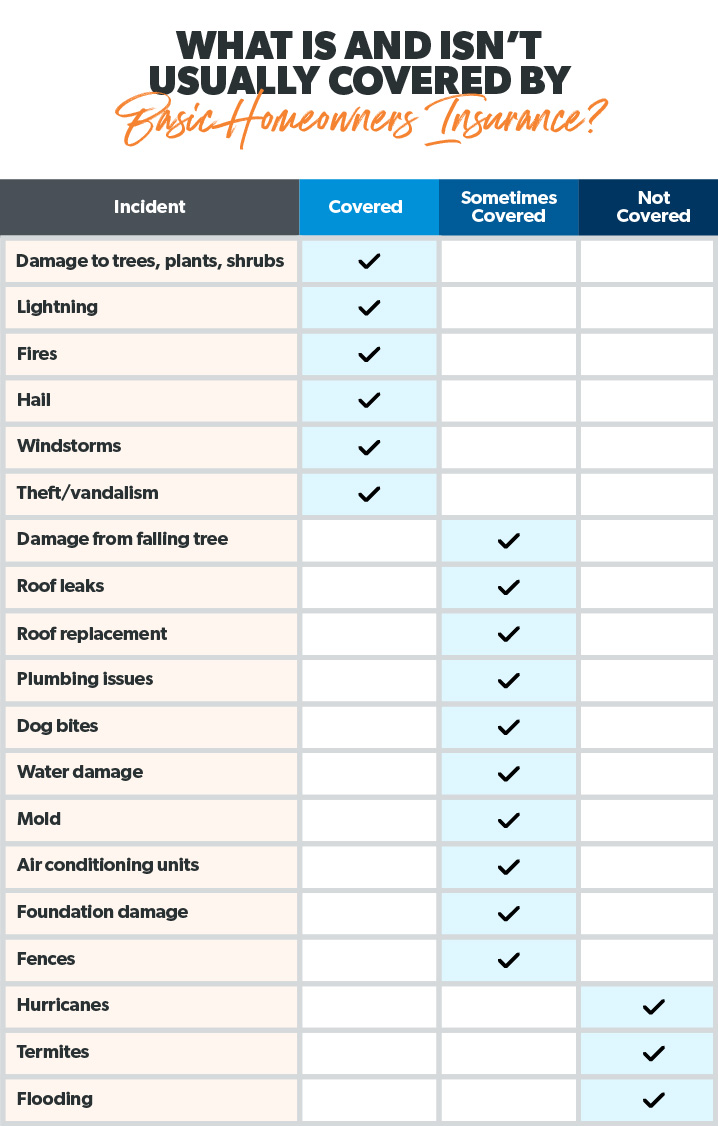

Safeguarding inexpensive home insurance is essential for safeguarding one's home and financial well-being. Home insurance coverage gives defense against various risks such as fire, burglary, all-natural calamities, and personal responsibility. By having an extensive insurance coverage plan in position, home owners can relax guaranteed that their most significant investment is shielded in case of unanticipated scenarios.

Cost effective home insurance not only offers economic safety however also offers comfort (San Diego Home Insurance). Despite increasing building worths and building and construction expenses, having a cost-efficient insurance coverage guarantees that house owners can easily reconstruct or fix their homes without facing considerable financial concerns

Additionally, budget friendly home insurance can likewise cover individual belongings within the home, offering reimbursement for items harmed or taken. This insurance coverage prolongs beyond the physical framework of the residence, protecting the contents that make a residence a home.

Protection Options and Purviews

When it involves insurance coverage limits, it's essential to understand the maximum amount your policy will pay out for each kind of insurance coverage. These restrictions can differ depending on the policy and insurance company, so it's important to review them meticulously to ensure you have appropriate security for your home and possessions. By understanding the protection choices and limitations of your home insurance coverage policy, you can make informed decisions to secure your home and liked ones efficiently.

Factors Affecting Insurance Expenses

A number of variables substantially affect the costs of home insurance plan. The location of your home plays an essential role in identifying the insurance coverage premium. Residences in areas prone to all-natural disasters or with high criminal activity rates commonly have greater insurance expenses as a result of increased risks. The age and condition of your home are likewise factors that insurance companies consider. Older homes or residential properties in bad problem may be a lot more pricey to guarantee as they are more prone to damage.

Additionally, the type of coverage you pick directly impacts the expense of your insurance coverage plan. Choosing for extra coverage choices such as flood insurance coverage or quake protection will raise your costs.

In addition, your credit rating, declares background, and the insurance provider you choose can all influence the price of your home insurance plan. By thinking about these variables, you can make educated decisions to aid handle your insurance costs successfully.

Comparing Carriers and quotes

In addition to contrasting quotes, it is important to assess the track record and financial stability of the insurance policy service providers. Look for consumer testimonials, rankings from independent agencies, and any kind of history of grievances or regulatory activities. A reliable insurance coverage service provider ought to have a great record of quickly refining insurance claims and providing superb customer care.

Additionally, consider the details protection functions used by each service provider. Some insurance companies might provide fringe benefits such as identity burglary protection, equipment Clicking Here break down coverage, or protection for high-value products. By thoroughly contrasting quotes and providers, you can make an informed choice and pick the home insurance strategy that ideal fulfills your requirements.

Tips for Reducing Home Insurance Coverage

After completely comparing providers and quotes to find the most appropriate coverage for your requirements and spending plan, it is prudent to explore reliable methods for saving on home insurance policy. Lots of insurance firms supply price cuts if you purchase multiple policies from them, such as incorporating your home and vehicle insurance policy. Regularly examining and updating your plan to reflect any changes in your home or conditions can guarantee you are not paying for protection you no longer requirement, assisting you save cash on your home insurance premiums.

Conclusion

To conclude, guarding your home and loved ones with affordable home insurance coverage is critical. Understanding insurance coverage limitations, aspects, and options impacting insurance prices can help you make notified decisions. By contrasting quotes and providers, you can find the most effective policy that fits your needs and spending plan. Executing pointers for reducing home insurance coverage can additionally assist you secure the essential defense for your home without breaking the financial institution.

By unraveling the intricacies of home insurance coverage plans and checking out sensible strategies for securing economical coverage, you can ensure that your home and loved ones are well-protected.

Home insurance policy policies typically provide a number of coverage choices to secure your home and personal belongings - San Diego Home Insurance. By understanding the coverage options and restrictions of your home insurance policy, you can make educated choices to secure your home and loved ones effectively

On a regular basis assessing and updating your plan to show any kind of adjustments check these guys out in your home or conditions can ensure you are not paying for coverage you click for source no longer requirement, assisting you save money on your home insurance premiums.

In final thought, guarding your home and loved ones with inexpensive home insurance coverage is important.

Report this page